Market leading knowledge & insights to help you live your property dream

PIPA is recognised as an authoritative source of property market analysis, research, and is a regular commentator in media nationwide.

PIPA is recognised as an authoritative source of property market analysis, research, and is a regular commentator in media nationwide.

The PIPA Adviser is a quarterly industry e-magazine that features the latest industry news, research, state market analysis, and PIPA happenings, including upcoming events, member profiles, and media mentions.

For more information, feedback, or to feature in the PIPA Adviser, please contact us.

When it comes to most aspects of life, $1 Million goes a long way. Whether it’s a lifetime of family groceries1, 75 years’ worth of household transport costs, or smashed avocado for breakfast every day, for over 100 years.

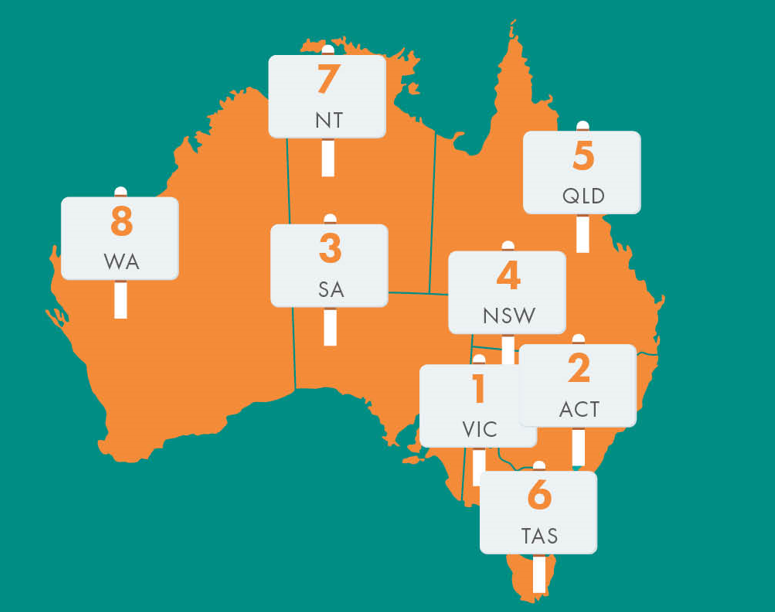

The first quarter of this year has been characterised by diverse market conditions around the nation, according to PIPA members.

The sell-off of investment properties around the nation is continuing unabated and is fuelling fears of an even tighter rental market with higher holding and compliance costs as well as new property taxes to blame.

The first six months of this year has seen a continuation of robust market conditions in most major markets, with the exception of Melbourne.

When something awful is happening to a lot of people, it helps if those in charge have someone to conveniently blame. Investors of Australia, this is where you come in.

Renters are set to take a hit with investors bailing on rentals in areas where costs and red tape are starting to bite, with surprise revelations of what they’re eyeing next.

Victorian first-home buyers are getting priced back into the property market as the time needed to save a deposit drops.

Melbourne based Richard Crabb of the ASPIRE Property Advisor Network is on the PIPA Board and hopes to represent professional working within the new property space.

Property investors might be shying away from the market but an unlikely state has emerged as an investor favourite at a time when mortgage arrears keep climbing upwards.

One in five investors who sold within the last 12 months held their properties for less than three years, showing how cost pressures are impacting churn.

Property investors are abandoning the rental market in droves, with new data showing a significant increase in investment property sales over the past year.

The 2024 PIPA Annual Property Investor Sentiment Survey was conducted in August 2024 and surveyed Australia’s existing and aspiring property investors.

The sell-off of investment properties around the nation is continuing unabated and is fuelling fears of an even tighter rental market with higher holding and compliance costs as well as new property taxes to blame, according to the 2024 PIPA Annual Investor Sentiment Survey.

Port Adelaide is a water-side region about 14km northwest of the Adelaide CBD.

While its history has been as a port and industrial hub, that has changed in recent years with significant housing in the area and the region earmarked for significant future gentrification along its waterside areas.

A tenant’s union has called out the federal government for increasing rental assistance by about $20, believing they were offering “crumbs disguised as cakes”

The Victorian government has made the Consumer Affairs Victoria underquoting task force permanent but there are fears underlying legislation needs to be strengthened.

The Victorian government has been blamed for driving Melbourne’s property market so far into the ground that the city has plunged to the nation’s sixth-most affluent capital in one key measure.