Market leading knowledge & insights to help you live your property dream

PIPA is recognised as an authoritative source of property market analysis, research, and is a regular commentator in media nationwide.

PIPA is recognised as an authoritative source of property market analysis, research, and is a regular commentator in media nationwide.

The PIPA Adviser is a quarterly industry e-magazine that features the latest industry news, research, state market analysis, and PIPA happenings, including upcoming events, member profiles, and media mentions.

For more information, feedback, or to feature in the PIPA Adviser, please contact us.

When it comes to most aspects of life, $1 Million goes a long way. Whether it’s a lifetime of family groceries1, 75 years’ worth of household transport costs, or smashed avocado for breakfast every day, for over 100 years.

The first quarter of this year has been characterised by diverse market conditions around the nation, according to PIPA members.

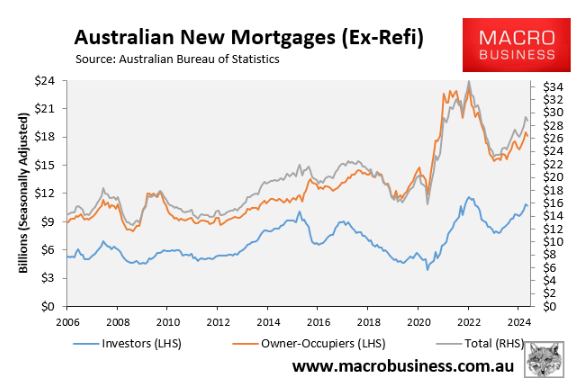

The sell-off of investment properties around the nation is continuing unabated and is fuelling fears of an even tighter rental market with higher holding and compliance costs as well as new property taxes to blame.

The first six months of this year has seen a continuation of robust market conditions in most major markets, with the exception of Melbourne.

When something awful is happening to a lot of people, it helps if those in charge have someone to conveniently blame. Investors of Australia, this is where you come in.

The first six months of this year has seen a continuation of robust market conditions in most major markets, with the exception of Melbourne, according to the latest PIPA National Market Update.

The cost-of-living crisis is being felt in many households, and while landlords have been highly maligned for rising rent prices, they’ve also had to bear the brunt of interest rate hikes and rising mortgage costs.

There’s something a little unusual going on in Melbourne. No, it’s not carrot man or fake seizure guy. Rather, it’s got to do with the property market.

Debra Beck-Mewing completed her QPIA while running her advisory business, The Property Frontline.

The first six months of this year has seen a continuation of robust market conditions in most major markets, with the exception of Melbourne.

Australia’s housing market is experiencing “an exodus of investors” according to Jonathan Chancellor.

The Shoalhaven region is attracting new residents because of its relaxed lifestyle and extensive areas of natural beauty, including forests and pristine beaches.

A huge percentage of homes for sale in each of these investor hotspots has been ripped from the rental pool over the past year.

More than 100 Victorian areas have had landlords behind a worryingly high number of residential home sales. Search the most-affected areas.

ABS data shows a spike in dwelling approvals for May, but questions remain whether this will be enough to keep pace with housing demand.

Ceyhun and Danielle Guengoer just bought their first home in Melbourne. It used to be a rental. For Mr Guengoer, the experience had been 60 per cent excitement, 40 per cent fear of having a large mortgage.

Cash-strapped states have upset investors with a surge in land tax charges, so who will be hit next and which state will take advantage of the disenchantment?