Which capital city had the most median house price growth over the past 20 years?

Apr 2023Karen Millers

Categories

Location ReportsMedia releasesNational market updatesPersonal advisersPIPA AdviserPIPA Annual Investor Sentiment SurveysPIPA Member ProfilesPIPA video updatesPIPA webinarsPodcastsProperty advisersProperty newsLatest Articles

Which property cycle are we in?

Rent rises ease but crisis’ link to population density found to be tenuous

Jordan van den Berg: The ‘Robin Hood’ TikToker taking on Australian landlords

Victorian property investors face yet another new property tax as council tests levy

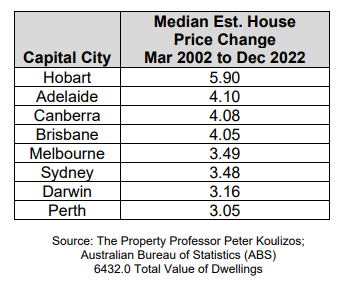

While Sydney and Melbourne regularly steal the property media headlines, it was our nation’s smaller capital cities that achieved the best median house price growth over the past two decades, according to exclusive new research.

Property Investment Professionals of Australia (PIPA) board member, former PIPA chair, and respected University of Adelaide property academic, Peter Koulizos, has crunched the numbers to determine which capital city had the most established median house price growth since 2002.

Mr Koulizos analysed the Australian Bureau of Statistics’ (ABS) median price of established house transfers from March 2002 to December 2022 and the results will probably surprise plenty of property pundits.

“We always hear about the property markets of our two biggest capital cities because a large proportion of our national population live there, but when it comes to the performance over the long-term, they both are well down the leaderboard according to my analysis,” Mr Koulizos said.

“According to the ABS data, Hobart was the star performer by a country mile over the past two decades, which just goes to show that smaller cities as well as major regional areas can be sound property investment locations.”

Mr Koulizos’ analysis found that the median established house price in Hobart was 5.9 times higher in December 2022 than it was in March 2002, with its median price soaring from $123,300 to $727,000 over the period.

The second-place getter was another small capital city, with Adelaide’s established median house price 4.1 times higher than 20 years ago with its price increasing from $166,000 to $680,000.

Coming third was Canberra, where its median house price is currently 4.08 times more than it was in March of 2002 with its price growing from $245,000 to $999,000 over the period.

Mr Koulizos said our three biggest capital cities produced stellar established median house price increases over the period, too, with Brisbane’s quadrupling from $185,000 to $750,000; while Melbourne and Sydney’s more than tripled, increasing from $241,000 to $842,000 and $365,000 to $1.27 million respectively.

Rounding out the capital city list were Darwin and Perth, where their established median house prices are 3.16 and 3.05 times higher now than in March 2002 with Darwin’s price now $600,000, up from $190,000, and Perth’s median price currently $580,000, up from $190,000 two decades ago, he said.

“What these statistics also showed was that every capital city had periods where median house prices fell, rose, or flat-lined because of a variety of economic factors, including two major global events over the time period in the GFC and the COVID19 pandemic,” Mr Koulizos said.

“As property investment professionals we always encourage property buyers to purchase property as a long-term investment and to do their best to ignore any temporary impacts on median prices or markets more generally.

“That’s because, as these results show, real estate has a proven history of performance over the decades, with our nation offering a plethora of places – capital city and regional – where homeowners and property investors can strategically purchase property.”

ENDS

For more information, or to organise an interview please contact:

Peter Koulizos | 0412 781 236