What it really costs to own an investment property

Mar 2025Karen Millers

Categories

Location ReportsMedia releasesNational market updatesPersonal advisersPIPA AdviserPIPA Annual Investor Sentiment SurveysPIPA Member ProfilesPIPA video updatesPIPA webinarsPodcastsProperty advisersProperty newsUncategorisedLatest Articles

The 10 “hottest” property markets around the nation revealed

TEA TREE GULLY : North Eastern Suburbs of Adelaide

Safeguarding Property Businesses Against Cyber Threats

Young purchasers sidelined as key buyer group returns to market

Buying an investment property that takes care of itself financially – it sounds like an attractive proposition.

But when it comes to calculating a property’s cashflow, there’s far more to it than seeing if the rent will cover your mortgage repayments each month.

There are a range of other expenses that need to be factored in when crunching the numbers on an investment property so much so that avoiding a negative cashflow often proves elusive, Property Investment Professionals of Australia (PIPA) chair Nicola McDougall says.

In PIPA’s 2024 Investor Sentiment Survey, nearly 65 per cent of respondents said their investment portfolio had a negative cashflow, up from 57 per cent the year prior.

“A lot of first time investors, if they haven’t done their research correctly or if they aren’t working with experts, fail to understand that their properties are very unlikely to be neutrally or positively geared at the beginning,” McDougall says.

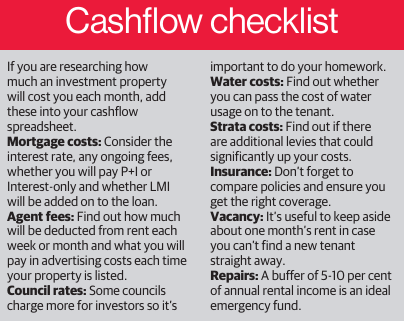

So what expenses should you add up when calculating the holding costs of an investment property?

Agent Fees

Property management fees are an important cost to remember, McDougall says.

Depending on where you live and what your agent is charging, this could be around 5-8 per cent of your weekly rent so it’s a decent deduction that should be factored in from the onset.

It’s also important to factor in leasing and admin costs for when the property comes on to the market, says director of Rethink Residential, part of investment company Rethink Group, Mina O’Neill.

Council, Water and Strata

Council rates are paid quarterly or annually depending on your location and size, says O’Neill.

Depending on the type of dwelling and lease agreement, you may also need to pay water costs and rates.

“If there’s extra (water) usage costs some of them can be passed on to the tenants,” O’Neill says.

“Each state is different.”

If the property is part of a complex of apartments or villas, you will also need to pay strata fees, which often come with building insurance and admin fees.

Special levies can sometimes be thrown in depending on work being done at the complex.

Repairs and Maintenance

The cost of repairs and maintenance is often overlooked by first time investors, yet it’s one of the most important expenses to budget for, McDougall says.

“It’s important to make sure that you always have access to funds,” she says.

“Sometimes repairs need to be done that come out of the blue and you need to come up with several thousand dollars very quickly. If you’re not able to do that and there’s a potential issue with the tenancy legislation, there’s a potential issue with your ability to continue to hold on to the property.”

O’Neill says she keeps a buffer of 5-10 per cent of a property’s annual rental income as an emergency fund to pay for repairs.

Insurance and Vacancy

Insurance is another crucial cost that should be factored in to cashflow calculations, says McDougall. She says investors should have landlord insurance as well as property insurance and content insurance depending on their situations.

It’s also important to keep a buffer of at least two to four weeks’ worth of rent per property a year to cover vacancies, O’Neill says.

Originally Published: Kate McIntyre | Herald Sun | 22 March 2025

“Licensed by Copyright Agency. You must not copy this work without permission.”