Victoria named worst State for renters as net annual investor numbers nationally fall 55% in five years

Jun 2023Karen Millers

Categories

Location ReportsMedia releasesNational market updatesPersonal advisersPIPA AdviserPIPA Annual Investor Sentiment SurveysPIPA Member ProfilesPIPA video updatesPIPA webinarsPodcastsProperty advisersProperty newsLatest Articles

Which property cycle are we in?

Rent rises ease but crisis’ link to population density found to be tenuous

Jordan van den Berg: The ‘Robin Hood’ TikToker taking on Australian landlords

Victorian property investors face yet another new property tax as council tests levy

The highest stamp duty in the country, a new land tax set to slug mum and dad investors, the threat of rent controls, and more than 100 tenancy reforms in two years has resulted in Victoria being named the worst State for renters in the nation, according to the Property Investment Professionals of Australia (PIPA) and the Property Investors Council of Australia (PICA).

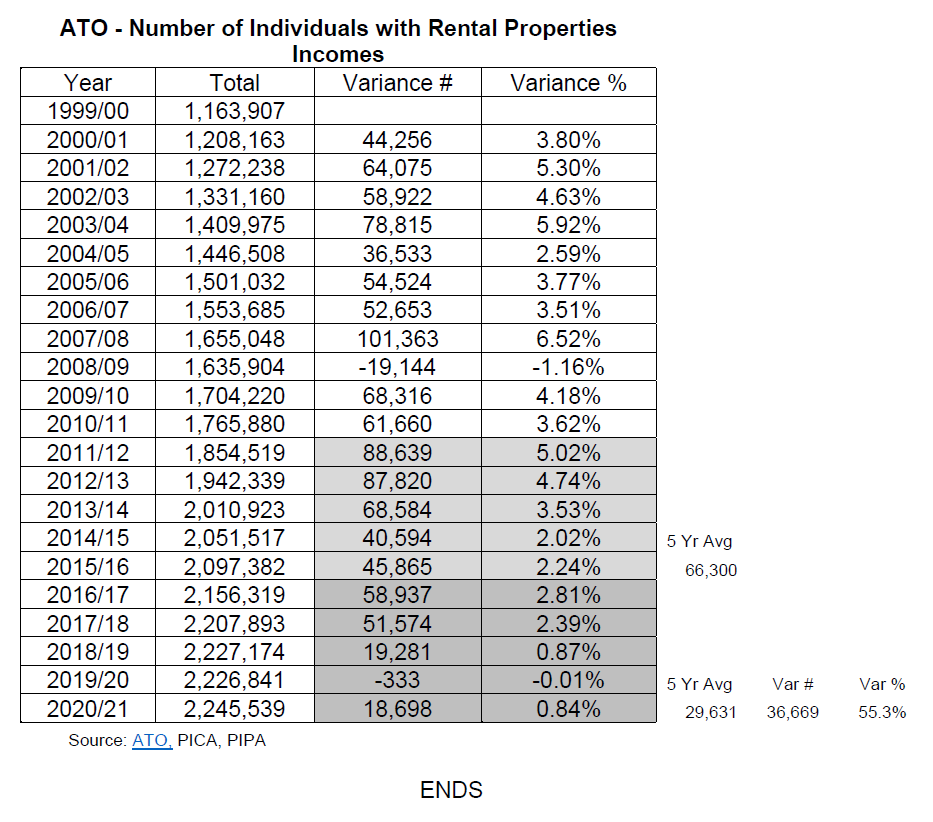

Analysis of new ATO data also shows that the net average annual number of people with rental property incomes has fallen a staggering 55 per cent in five years.

Analysis of the ATO’s Individual Taxation Statistics for 2020-21 found that the average increase in net individual investors every year in the five years to 2015/2016 was about 66,000, but in the five years to 2020/21 this figure had fallen off a cliff to about 29,600 – including a negative result in 2019/20 when investor numbers actually fell by 333.

PICA Chair Ben Kingsley said it’s clear the number of net individual investors isn’t keeping up with net rental demand and the constant attacks and financial imposts on investors over the past five years in particular has pushed the country into a rental crisis with Victoria the worst of the lot.

“Never in my lifetime would I have thought that a government of the day could be that dumb to consider rental freezes, yet, the Victorian Labor Government is sounding a very clear message to mum and dad property investors – telling them your money is not required in Victoria, even though it has one of the lowest rental vacancy rates in the country,” Mr Kingsley said.

“Whilst most renters will think this is a welcome short-term relief measure, the chronic shortage of rental properties in this state will remain for years and decades to come, ultimately causing severe economic harm to a state that is already challenged by record levels of debt.

“This will lead to higher rents for longer, as investors choose to invest their money in other states and territories where the suppliers of the majority of rental properties in this country are treated with more respect than they are in Victoria.”

PIPA Chair Nicola McDougall said investors had been selling up for years – which had resulted in a critical undersupply of rental properties nationwide – because for many it’s just not worth the financial risks nor the constant requirements to fund State Government coffers via higher taxes.

“PIPA has been warning for nearly a decade about the negative impacts of market intervention on rental markets, starting with the APRA lending restrictions that came into effect in 2015, and now a variety of rent caps or controls,” she said.

“The ATO stats don’t lie, investors have already deserted markets around the nation – and especially in Victoria and Queensland – because they no longer have control of their assets.

“The negative annual result for investor numbers during the first year of the pandemic was the first time this had occurred since the GFC more than a decade before but is set to happen again sooner rather than later as investors sell up in droves.”

Mr Kingsley said the latest investor threat was the Victorian Government allegedly considering rent controls, which will further decimate the state’s rental market.

“We’ve had 12 interest rate increases and this proposed move by the Victorian Labor Government will be the straw that breaks the backs of many property investors,” Mr Kingsley said.

“Not being able to recover some of these costs will mean some mum and dad investors will be forced to sell, and with other budding property investors snubbing Victoria because it’s too hard and too costly to hold properties, the story is going to be pretty dire for the state and for all renters living there.

“There is a real risk that the State and its economy is going to become a basket case – like the John Cain/Joan Kirner State Labor government of the late 80s and early 90s – which took almost two decades to turn back around.

“It’s clear we have a housing supply issue that’s only going to get more challenging with more immigration planned which will result in many overseas migrants choosing to settle in other states and territories because there will literally be nowhere available to rent in Victoria.”

For more information or to organise interviews, please contact:

Bricks & Mortar Media on media@bricksandmortarmedia.com.au

About PIPA

Property Investment Professionals of Australia (PIPA) is a not-for-profit association established by industry practitioners with the objective of representing and raising the professional standards of all operators involved in property investment.

About PICA

PICA is a not-for-profit organisation committed to advocating and lobbying on behalf of property investors’ interest and educating its members on the economic benefits and risks of property investing in Australia.

For more information visit www.pica.asn.au