Expert warning over home seller’s remorse

Oct 2023Karen Millers

Categories

Location ReportsMedia releasesNational market updatesPersonal advisersPIPA AdviserPIPA Annual Investor Sentiment SurveysPIPA Member ProfilesPIPA video updatesPIPA webinarsPodcastsProperty advisersProperty newsUncategorisedLatest Articles

The 10 “hottest” property markets around the nation revealed

TEA TREE GULLY : North Eastern Suburbs of Adelaide

Safeguarding Property Businesses Against Cyber Threats

Young purchasers sidelined as key buyer group returns to market

Rising interest rates are putting pressure on the hip pockets of property investors across the country, with many choosing to sell up – but experts are warning of seller’s remorse.

A recent property investment sentiment survey conducted by the Property Investment Professionals of Australia (PIPA) shows interest rate hikes alongside higher government charges and tenancy reforms have led to many investors offloading at least one property in the last 12 months.

“We are starting to see more and more investors clearly unable to hold onto their properties,” said PIPA chair Nicola McDougall.

But while it may be tempting to sell now while the market is strong, property investment professionals say there are several good reasons investors should weather the interest rate storm and hold onto their properties for the long haul – they can.

Rental Returns

A national shortage of rental accommodation has driven vacancy rates down and rents up.

PropTrack data shows rents have risen 14.6 per cent nationally over the past year and 18 per cent across Sydney and 13.6 per cent across Melbourne as a result of the imbalance in supply and demand – a trend likely to continue.

“Rental returns are likely to be very strong going forward,” said PropTrack senior economist Paul Ryan, nothing there were not enough properties available to meet rental demand.

Real Estate Buyers Agents Association (REBAA) president Melinda Jennison from Streamline Property Buyers says this is a good reason to hold onto an investment property.

“When you’ve got a smaller supply of properties available for rent, you’ve got that upward pressure on rents,” she said. “It’s the long term horizon that investors need to remain focused on.”

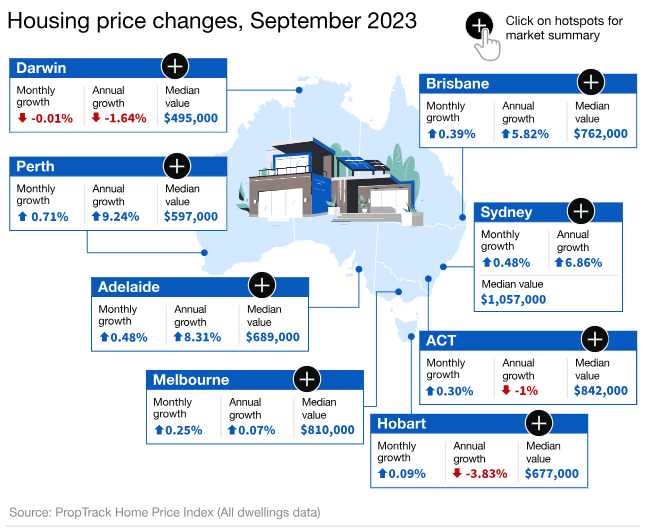

Property Prices

The same can be said for capital growth, said founder and managing director of Empower Wealth Ben Kingsley.

While conditions for sellers are strong in markets like southeast Queensland, Adelaide and Perth, those who hold onto their property rather than sell now will benefit even more.

“You will be greatly rewarded in terms of the overall returns that you get,” he said.

“Those that do sell (now) will be, unfortunately, disappointed in several years’ time when they reflect on what the value of that asset would be and the passive income that they would be benefiting from as part of that investment,” he said.

Ms Jennison said increased migration and a lag in home building would keep property prices strong well into the future.

“Generally when you’re in a really low supply environment and there is still demand for properties, the prices will escalate and continue to go up over the long term,” she said.

Interest Rates

Investors need to remember that not only does property operate in cycles of peaks and troughs, so too do interest rates, Ms Jennison added. “Lots of commentary suggests interest rates are at or near the peak, and potentially some time in 2024 we’ll start to see interest rates come back again,” she said. “For property investors that means their holding costs could reduce if they can get through the next few months.”

Buyer’s agent and author of Rethink Property Investing Scott O’Neill said there was light at the end of the tunnel for property investors feeling the pinch.

“If you can hold on I think it’s going to mean a higher price,” he said. “In 12 months, rents are definitely going to be higher. There is the potential for an interest-rate cut. People might be less inclined to sell if there’s talk of rate drops, so you might find that supply contracts … if you’re thinking of selling, that’s the market you’d rather drop a property into.”

Originally Published: Kate McIntyre | Courier Mail | 16 October 2023

“Licensed by Copyright Agency. You must not copy this work without permission.”