Should homeowners and buyers worry about negative property market forecasts?

Jun 2022Karen Millers

Categories

Location ReportsMedia releasesNational market updatesPersonal advisersPIPA AdviserPIPA Annual Investor Sentiment SurveysPIPA Member ProfilesPIPA video updatesPIPA webinarsPodcastsProperty advisersProperty newsLatest Articles

Which property cycle are we in?

Rent rises ease but crisis’ link to population density found to be tenuous

Jordan van den Berg: The ‘Robin Hood’ TikToker taking on Australian landlords

Victorian property investors face yet another new property tax as council tests levy

Headlines lately have been filled with forecasts of a looming housing market correction, with wildly varying predictions of how far prices could dip.

Rising interest rates, falling consumer confidence and increasing costs of living are all cited as factors at play. But experts also say, when it comes to this correction, context is important.

ANZ and the Commonwealth Bank each expect a reduction of 15% between now and the end of 2023, while the National Australia Bank is tipping a 17% fall and Westpac is forecasting a 14% drop.

It’s a sharp reversal of fortunes from the end of 2021, when frenzied conditions saw a large number of buyers competing for a small pool of properties.

Fast-changing conditions can feel like a sign of doom and gloom to come, when in reality experts say things aren’t quite as dire as they might seem.

Putting price falls into perspective

PropTrack’s Home Price Index for May showed national growth fell for the first time since the start of the pandemic, with Sydney and Melbourne leading the charge.

Growth around the country is slowing, with some markets like Brisbane and Adelaide performing stronger.

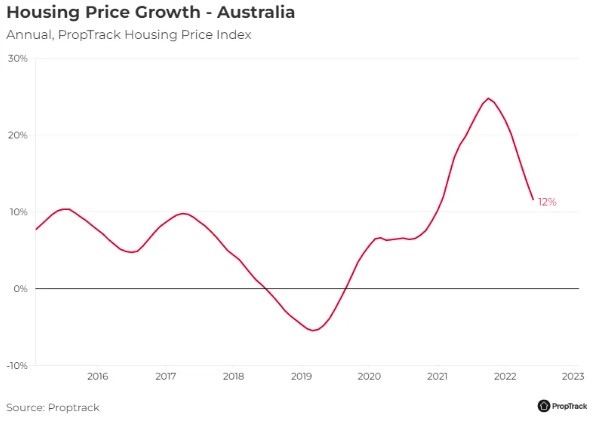

“However, this follows the third-fastest episode in Australia’s history, with prices nationally up 14% in the year to May, and 35% since March 2020,” report author Paul Ryan, an economist with PropTrack, pointed out.

By comparison, home prices nationally dropped by 0.11% in May, while in Sydney they were down by 0.29% and in Melbourne by 0.27%.

Even if prices fall as sharply as the major banks predict over the next 18 months, those losses won’t absorb even half of the increases seen, Cameron Kusher, executive manager of economic research at PropTrack, said.

“To put it into perspective, property prices would have to decline by 26% to get back to March 2020 levels,” Mr Kusher said.

“Although we are expecting property prices to fall over the coming period, and there may be some large falls, we don’t anticipate prices falling back to pre-Covid levels.”

Peter Swan is a professor at UNSW’s School of Business and said the boom in prices in the past few years was “far too high” and unsustainable.

Despite that, Professor Swan isn’t as convinced as some pundits that a significant drop is coming.

“I suspect the prices will not fall that much [further],” Professor Swan said. “Although, some people have speculated sizable reductions 20% to 25%.

“But vacancy rates are at an all-time low of around 1%. It’s extremely hard for people to get rental housing, and land restrictions have meant there has not been a massive increase in housing supply.

“So, I do not think we are going to see truly sizable falls in the next year or two.”

How high will interest rates rise?

Forecasts about the frequency and size of further rate hikes differ depending on who you ask, but there’s no doubt the Reserve Bank has adopted an aggressive approach.

RBA governor Philip Lowe has indicated an inflation rate of about 7% is expected this year, vowing to “do what is necessary” to bring it back within the 2% to 3% range.

That means more interest rate hikes.

Shane Oliver, chief economist at AMP, maintains his view that the cash rate will peak at 2.5%, but added: “It could come earlier than thought, given the RBA’s shift towards a more aggressive approach.”

Financial market expectations are for the cash rate to hit 3% this year, and to glide towards 4% over 2023.

That scenario would push interest payments from around 5.2% of income to around 12%, Dr Oliver said.

“When combined with the surge in fixed mortgage rates, which have already gone from around 2% to around 5%, it would likely cause real problems for consumer spending, a big spike in mortgage stress, and push property prices down by 20 to 30%,” he said.

“Which indicates it’s unlikely to happen, as it would crash the economy and ultimately push inflation back well below the RBA’s target.”

Some economic indicators are beginning to show a weakening, Dr Oliver said, including general consumer confidence. That suggests the RBA shouldn’t have to raise rates too sharply to meet its goal of slowing inflation.

Nicola McDougall is the chair of the Property Investment Professionals of Australia and believes too much has been made of the rising rates environment.

The domestic banking sector is so robust that new borrowers are already being financially stress-tested with an assessment factoring in two or even three percentage points of higher rates, Ms McDougall pointed out.

“This fact, as well as most borrowers being well ahead on their repayments, means that increases to interest rates are nothing to be feared by the majority of mortgage holders,” she said.

“Rising costs of living are more of an issue for most households, with inflation now well above the Reserve’s 2% to 3% target band. However, the RBA has indicated that it expects high inflation to be a temporary situation, rather than a permanent one.

“Further, most major banks appear to be pricing in a maximum interest rate of around 5% to 6% within two years, which is still relatively low compared to historical averages.”

The mid-term outlook for housing demand

A number of factors are combining to contribute to the likelihood of continued demand for properties in some parts of the country, Mr Ryan said.

It won’t be quite as strong as seen in recent years, but it means a mass exodus of prospective purchasers is unlikely in many regions.

Overseas migration will create more demand

For one, overseas migration – which ground to a halt during Covid as the country’s border shut – is expected to resume with gusto imminently.

Many of those new arrivals tend to settle in inner-city areas, particularly in major cities like Sydney and Melbourne, and they typically rent at first, Mr Ryan said.

Already, there is a critical shortage of rental properties in most cities, but especially in inner-city suburbs where demand is skyrocketing, and housing supply is very low.

“This will contribute to the continued increase in investor activity, which combined with immigration, is likely to benefit the major cities over the rest of the year,” Mr Ryan said.

Ben Plohl, director of BFP Property Buyers, said the doom and gloom sparked by overly dire forecasts is “battering” general consumer confidence.

“No doubt this is and will continue to dampen buyers’ appetites when buying real estate and the market will continue to flatten and be quite patchy,” Mr Plohl said.

“The trajectory of the cash rate will be one to watch very closely as this will have an effect on market direction.”

In the Sydney market, a clear transition towards more balanced conditions is clear, he said, with a growing number of price guides dropping and homes being passed in at auction.

“A-grade properties are still moving and for good prices, however, we are seeing a significant slowdown in B- and C-grade stock,” he said.

“Overall, the market is quite patchy with no distinct trend or pattern. Although numbers at some open homes have been down, we are noticing a lot of opportunists appearing.”

Investor activity in many parts of the country remains strong on the back of slowing price growth, reduced buyer competition, and rapidly rising rental prices.

Interstate migration

Also driving increased buyer demand in particular markets is sustained interstate migration, with significant new arrivals in hotspots like southeast Queensland.

“Interstate migration is at its highest level in 20 years and there are a number of factors contributing to this,” Meighan Wells, director and principal of Property Pursuit, said.

“The Covid-created work from home revolution appeared to some families to be the answer to the question that they did not even know they had pre-March 2020.

“Not only is the weather beautiful one day, perfect the next, a yearning to slow down the pace of life and spend more time doing family-oriented activities appears to be at an all-time high post-Covid restrictions.”

Adelaide has also seen strong levels of interstate migration, on top of rising interstate from investors based elsewhere in the country.

Adam Hindmarch, director of Prospa Property Advisory, said the South Australian capital is “firmly on the radar” for would-be landlords in the eastern states.

“Real estate agents across Adelaide are reporting that it is not uncommon for more than 50% of enquiries on a listing to come from interstate investors and buyer groups,” Mr Hindmarch said.

“Affordability is a strong motivator for many investors. In the northern suburbs you can still buy a standalone house in the $300,000s. In the southern suburbs there can also ‘bargains’ in the low $400,000s.”

A continued constraint on supply is likely

The number of new listings hitting realestate.com.au soared to new-record levels towards the end of 2021 as buyer demand peaked.

While vendor confidence seems to be holding up relative to buyer sentiment, there are some early signs of hesitancy.

Any drop-off in new listings would mean a reduction in overall supply, at a time when stock is running below the five-year average across the major capital cities.

“Meanwhile building approvals are falling away, and with the costs of materials and construction [up], some of the dwellings under construction may not be completed in a timely manner,” BuyersBuyers co-founder and buyer’s agent Pete Wargeant said.

“A dearth of new supply is set to characterise the market over the next couple of years.”

Cooling markets are good news for some

For would-be buyers who might struggle to compete during hot markets, such as first-home buyers, debut investors, or those with a smaller budget, a cooler market can be welcome.

There’s less competition, a lower sense of urgency to transact, more choice, and a better chance of securing a favourable deal.

Of course, whether or not now is a good time to buy depends on the prospective purchaser’s own circumstances.

“But if you have saved a lot during Covid, accumulated sizeable financial reserves, and feel confident, we may see some modest price reductions in the next few months as interest rates climb,” Professor Swan said.

“This could improve the housing position for you to make the purchase.”

Help for hopeful homebuyers

The change of government in May brings with it some new housing policies that will make it easier for some Australians to buy their first home.

Prime Minister Anthony Albanese’s flagship election commitment is Help To Buy, which will see the government ‘co-purchase’ a home with eligible buyers, reducing the amount they need for a deposit and the size of mortgage repayments.

In a nutshell, the shared equity scheme will allow 10,000 participants a year to buy a home with a deposit of as little as 2%, with a maximum 40% stake taken by the Commonwealth. Individuals earning less than $90,000 and couples earning under $120,000 would be eligible.

In addition, the new government will extend the existing Home Guarantee program with an extra 10,000 places for regional first-home buyers.

Like Home Guarantee, it will allow eligible participants to buy a property with a deposit of as little as 5%, with the Commonwealth guaranteeing the rest to avoid the need to pay lenders mortgage insurance therefore reducing both upfront costs as well as those over the lifetime of the loan.

Assistance for homebuyers, whether first-timers or those in other in-need groups like key workers, exists in other states and territories around the country, from cash grants to shared equity schemes.

Reflecting on past pessimistic predictions

As COVID-19 broke out and life as most people knew it changed overnight, a number of pundits offered their thoughts on what it could all mean for property prices.

Some forecast drops of 10% to 20%, while others went even further and predicted a crash in the order of 30% or more.

Instead, prices have risen by 30% since the onset of the pandemic.

Recent history has been littered with warnings of an imminent property market crash, from both reliable and questionable sources.

But those waiting for a wipe-out in order to jump on the real estate bandwagon will probably be disappointed, Professor Swan said.

“It is a bit of a pipe dream,” he said.

Originally Published | Shannon Molloy | realestate.com.au | 30 June 2022