Why FOMO is likely to return after ‘Mexican stand-off’ in QLD

Nov 2022Karen Millers

Categories

Location ReportsMedia releasesNational market updatesPersonal advisersPIPA AdviserPIPA Annual Investor Sentiment SurveysPIPA Member ProfilesPIPA video updatesPIPA webinarsPodcastsProperty advisersProperty newsLatest Articles

‘More chance of winning lotto’ than housing targets being met

PIPA Member Profile | Amanda Turner, Opulence Property

Median property values in Brisbane are now 2.77 per cent lower than at their peak in April, but there is a long way to go for prices to revert back to pre-pandemic values.

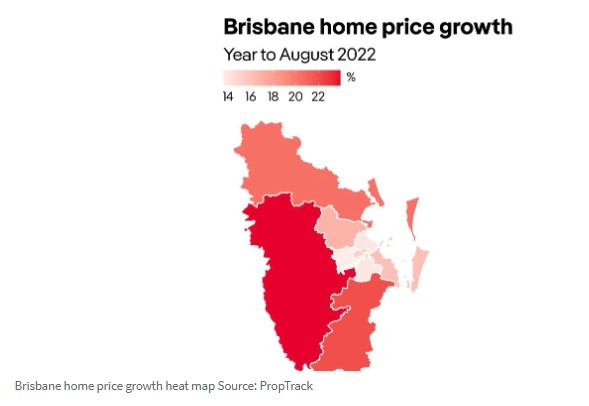

The latest PropTrack Home Price Index October 2022, out today, shows that the River City recorded a “slight fall” in values, down 0.09 per cent over the quarter.

“Prices are up just 7.51 per cent over the past year after recording annual growth rates above 30 per cent in early 2022 as the city benefited from the lifestyle and affordability trends that boosted the regions from the onset of the pandemic,” PropTrack senior economist and report author Eleanor Creagh said.

“Elevated net migration to South East Queensland is likely to continue to buffer price falls.”

Across Australia, only two capital cities recorded negative annual growth – Sydney (-6.28%) and Melbourne (-3.45%).

Adelaide has seen the strongest capital growth, up 14.23 per cent over the year, followed by Brisbane (+7.51%), Perth (+5.67%), Hobart (+2.95%), Darwin (+2.91%) and ACT (+0.94%).

Price falls in October were recorded in all capitals except Melbourne (+0.02%), Adelaide (+0.12%), Perth (+0.11%) and Darwin (+0.215)

The combined regional areas across all states recorded annual growth of between 3.63 per cent (Rest of NT) and 17.76 per cent (South Australia).

Regional Queensland values were up 8.67 per cent over the same period, but down 0.05 per cent over the quarter.

The Sunshine Coast, arguably one of the nation’s strongest markets during the pandemic property boom, recorded a 1.8 per cent drop in median values over the quarter.

Quarterly median values were up in Cairns (+0.4%), Gold Coast (0.58%) and Townsville (+0.73%).

The state’s annual growth stars were Wide Bay (+17.55%), Ipswich (+17.49%), Toowoomba (+12.96%), Logan-Beaudesert (+12.68%) and Moreton Bay North (+10.43%).

Ms Creagh said that rising interest rates had “quickly rebalanced the housing market from last year’s extreme growth”.

But with inflation increasing to 7.3 per cent, and another rate hike of 0.25 percentage points expected today, buyers borrowing capacities have taken a substantial hit.

“From here, further rate rises will increase borrowing costs and reduce maximum borrowing capacities, weighing on prices,” Ms Creagh said.

“However, this will be offset by tight rental markets and rental price pressures, rebounding foreign migration, low unemployment, and housing supply pressures.”

But it is not all doom and gloom, according to Ms Creagh.

“Sellers are adapting to market conditions after several months of price falls, while buyers are taking advantage of the less competitive conditions relative to spring last year and sentiment is finding a floor,” she said.

“The RBA appears done with front-loading the tightening cycle, now slowing the pace of its hikes.

“This may also give prospective buyers a confidence boost, along with the increased choice available compared to this time last year.”

If rates are lifted a further 0.25 percentage points, it will mark the seventh rate hike in a row and springboard the official cash rate to 2.85 per cent – its highest since 2013.

It also marks the fastest rise in the official cash rate since 1994.

The latest Property Investment Professionals of Australia (PIPA) National Market Update report, out yesterday, also noted the impact that the rapid rate rises were having on values.

PIPA chair Nicola McDougall said the significant uptick in rates in such a short period of time had resulted in many borrowers, and especially investors, not being able to secure lending to add to their portfolios – or even purchase one rental dwelling – which will create a further drag on markets in the months ahead.

“While opportunities clearly exist for homebuyers and investors in the current market, if they are unable to secure finance then we are likely to see a further reduction in prices as well as sustained downward pressure on vacancy rates for some time yet,” she said.

Brisbane-based buyers advocate Joanna Boyd said that while Brisbane’s market had settled into a new “normality”, buyers were also stuck wondering whether they should buy now or wait in the hope that the market might fall further.

“Over the past months, we have observed what appears to be a ‘Mexican Standoff’ between sellers and buyers,” she said.

“Sellers are still setting prices in their minds with figures that were being achieved six months ago, whereas buyers are not feeling as pressured to pay for a property above what they perceive to be the current market value.”

But Ms Boyd said that while FOMO had eased, it was likely to return in coming months as interstate migration for jobs and schooling opportunities ramped up again.

The biggest quarterly growth for houses was River Heads (+42.3%), Bundall (+34.4%), North Toowoomba (+32%), Runaway Bay (+32%) and Chelmer (+29.7%), according to the latest REA Market Trends report.

The biggest falls were at Noosa Heads (-42.5%), Clayfield (-27.6%), Graceville (-26.5%), Upper Mount Gravatt (-25.7%) and Longreach (-24.6%).

Originally Published: Samantha Healy | Herald Sun | 1 November 2022