Property investors expect prices to keep rising and want to work with qualified advisers: PIPA national investor survey

Sep 2021Karen Millers

Categories

Location ReportsMedia releasesNational market updatesPersonal advisersPIPA AdviserPIPA Annual Investor Sentiment SurveysPIPA Member ProfilesPIPA video updatesPIPA webinarsPodcastsProperty advisersProperty newsLatest Articles

‘More chance of winning lotto’ than housing targets being met

PIPA Member Profile | Amanda Turner, Opulence Property

Last year’s survey foreshadowed the property price growth that lay ahead – and it seems even more investors believe prices will keep rising this time around, too, according to the 2021 PIPA Annual Investor Sentiment Survey.

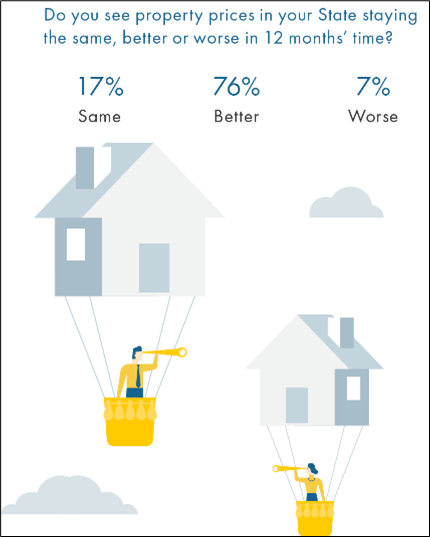

The national annual survey, which gathered insights online from nearly 800 property investors during August, found that more than 76 per cent of investors believe property prices in their state or territory will increase over the next year – up strongly from 41 per cent last year.

PIPA Chairman Peter Koulizos said few people believed the positive investor sentiment in last year’s survey, even though history had shown the resilience of real estate time and time again.

“When we think back to last year, which was a time of much fear and uncertainty, it’s clear that property investors and the market, in general, has weathered that turbulent period better than anyone dared to hope,” Mr Koulizos said.

“That said, last year’s survey did forecast the strong property price growth that we have since experienced, it’s just that not many people believed us at the time.”

Good time to invest

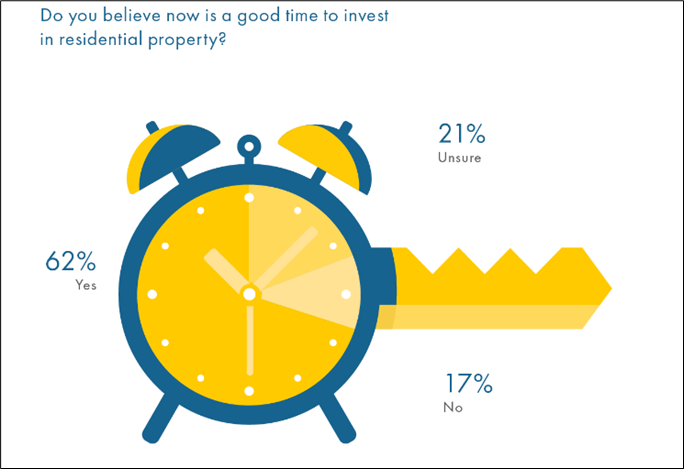

This year’s survey found that nearly 62 per cent of investors believe that now is a good time to invest in residential property, which is down from 67 per cent in 2020, and may be due to the high property price growth this year as well as significant lockdowns taking place at the time of the survey.

Nearly 21 per cent of respondents (up from 17 per cent in 2020) say the pandemic has made them consider moving to another location with the main reasons being improved lifestyle factors (78 per cent – same as last year), working from home in the future (42 per cent down from 46 per cent in 2020), and housing affordability (36 per cent down from 40 per cent last year).

However, about 25 per cent of respondents said their motivations to move included not wanting to live in crowded cities anymore as well as wanting to live somewhere that had fewer coronavirus cases and lockdowns.

Sunshine State property winner

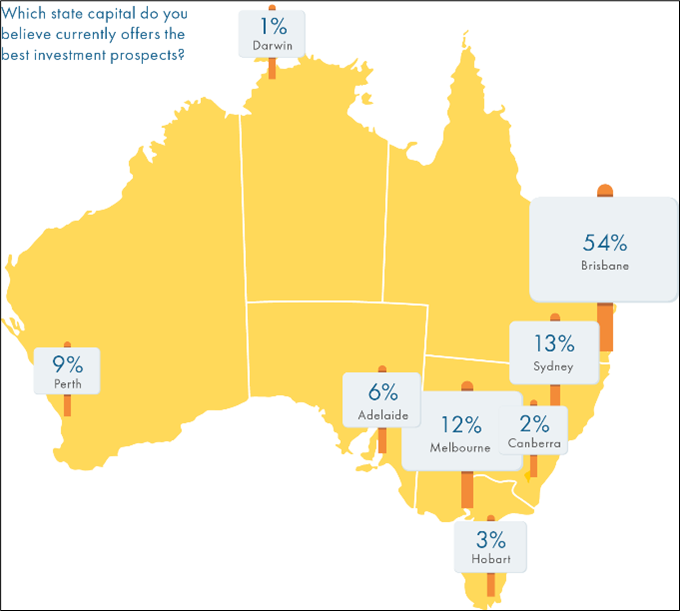

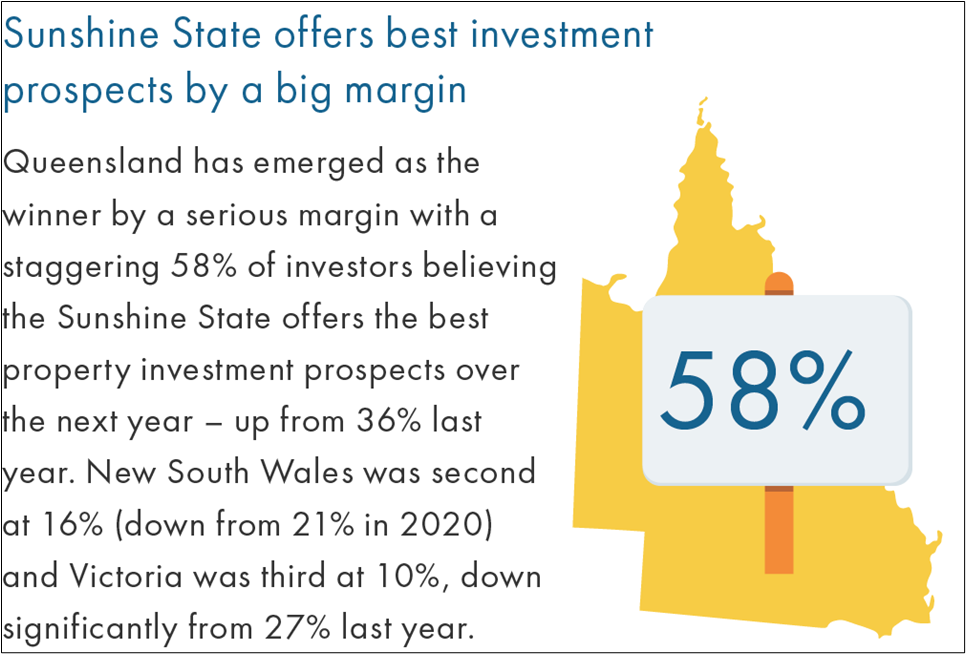

Mr Koulizos said this year’s survey produced the biggest ever margin when it came to the property investment location that investors believe offers the best potential over the next year.

“Queensland has certainly emerged as the winner in a serious way,” Mr Koulizos said.

“A staggering 58 per cent believe that the Sunshine State offers the best property investment prospects over the next year – up from 36 per cent last year.

“New South Wales was second at 16 per cent (down from 21 per cent in 2020) and Victoria was third at 10 per cent, which is down significantly from 27 per cent last year.”

The number of investors who see Brisbane as the state capital with the best investment prospects has also soared compared to last year’s results – up to 54 per cent compared to 36 per cent in 2020 – according to the survey results.

Mr Koulizos said the Southeast Queensland was the beneficiary of billions of dollars of major infrastructure projects that were set to transport the region, plus Brisbane was recently named the host of the 2032 Olympic Games.

“All of these factors, as well as the affordability of property in Southeast Queensland and strong interstate migration, are some of the reasons why investors are so optimistic about market conditions there,” he said.

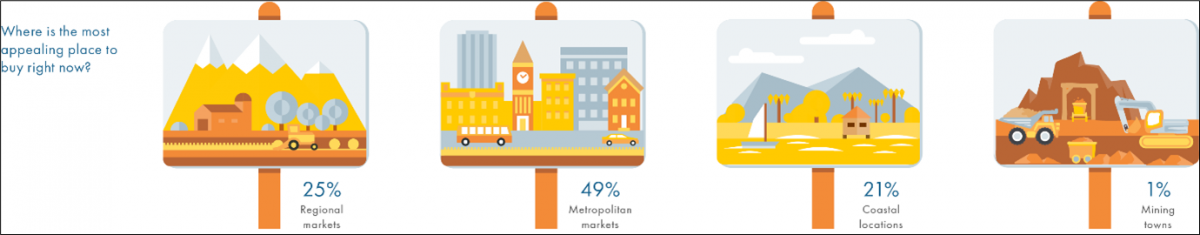

Mr Koulizos said a buying trend that began in last year’s survey appeared to be gathering momentum, with investors looking more and more outside metropolitan markets.

According to the survey, while nearly 50 per cent of investors say metropolitan markets offer the best investment prospects this was down from 61 per cent last year.

Regional markets continue to be in favour with 25 per cent of investors (up from 22 per cent), while interest in coastal locations has soared to 21 per cent from 12 per cent last year.

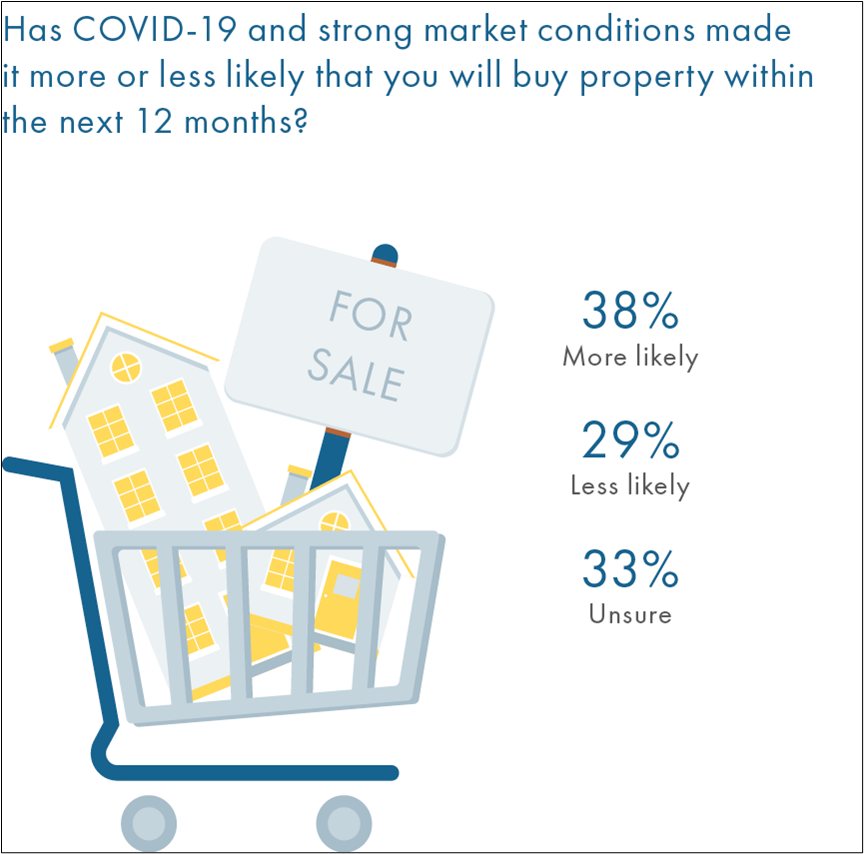

However, while investors remain upbeat about the market, about 29 per cent of investors say the pandemic has made it less likely they will buy a property in the next year – up from 21 per cent last year.

Fewer looking to sell

Likewise, the lingering impacts of the global health emergency – as well as the robust price growth over the past year no doubt – means fewer investors are looking to sell a property this year – at 59 per cent this year, compared to 71 per cent of survey respondents last year.

“Part of the reason for the uplift in property prices over the past year has been the continued low levels of supply in most locations around the nation,” Mr Koulizos said.

“With a decrease in the number of investors indicating they intend to sell over the short-term, it seems unlikely that this boom market cycle is going to change anytime soon.”

Seeking qualified advisers

Mr Koulizos said one of the most important results in this year’s survey was the fact that about 92 per cent of investors believe that any provider of property investment advice should have completed formal training or education.

“When markets are running hot it is more important than ever that buyers work with qualified property investment experts,” Mr Koulizos said.

“Unfortunately, at present, there is no legal requirement for people to have any training before calling themselves a property investment ‘adviser’.

“That’s why whether investors are looking for a qualified adviser, mortgage broker or accountant – essentially any professional involved in the property investment process – they should look for the Qualified Property Investment Adviser, or QPIA, logo as the best assurance that they are dealing with a trusted and educated professional.”

Summary of key findings

Investors still believe it’s a good time to invest

Nearly 62 per cent of investors believe now is a good time to invest in residential property, which is down from 67 per cent in 2020, and may be due to high property price growth as well as significant lockdowns taking place at the time of the survey.

Fewer investors selling

The pandemic continues to make it less likely that investors will sell a property over the next 12 months, according to 59 per cent of respondents (down from 71 per cent last year). However, about 18 per cent (up from seven per cent in 2020) said it had made them more likely to sell.

Sunshine State offers best investment prospects

Queensland has emerged as the winner by a serious margin with a staggering 58% of investors believing the Sunshine State offers the best property investment prospects over the next year – up from 36% last year. New South Wales was second at 16% (down from 21% in 2020) and Victoria was third at 10%, down significantly from 27% last year.

Regional and coastal markets in growing demand

While investors continue to tip metropolitan markets as offering the best investment prospects at nearly 50 per cent (but down from 61 per cent in 2020), regional markets are in favour with 25 per cent of investors (up from 22 per cent) as well as coastal locations with 21 per cent of survey respondents (up strongly from 12 per cent last year).

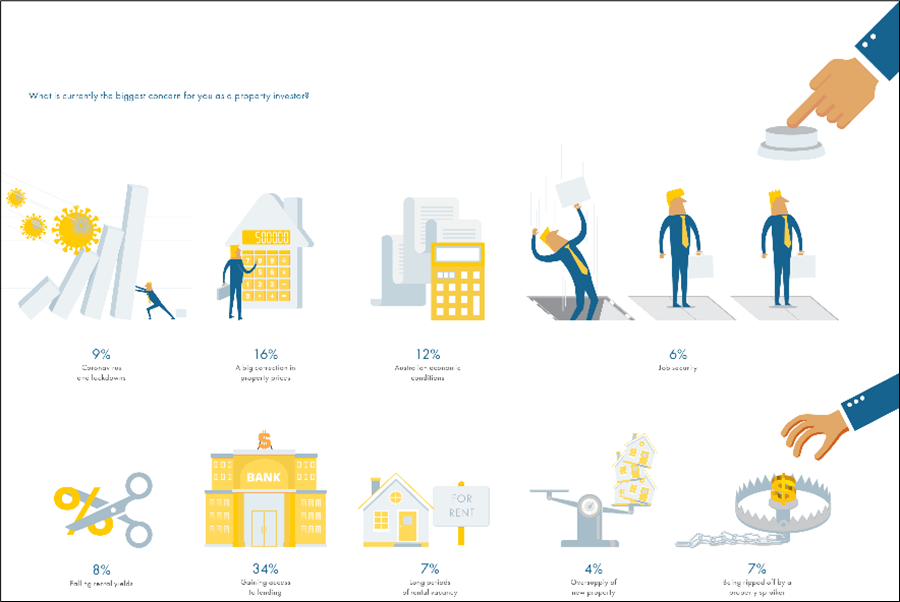

Lending and the economy remain top concerns for investors

The two leading concerns of the investors surveyed were gaining access to lending and Australian economic conditions – the same situation as last year.

Investors seeking out qualified advisers

Virtually all (92 per cent) investors continue to believe that any provider of property investment advice should have completed formal training or education. About 35 per cent of investors have sought the services of Qualified Property Investment Advisers or QPIAs.

ENDS

For more information, or to organise an interview with Peter Koulizos, please contact:

Bricks & Mortar Media | media@bricksandmortarmedia.com.au | 0405 801 979