Key housing groups ‘bizarrely’ excluded from Queensland’s housing crisis summit

Oct 2022Karen Millers

Categories

Location ReportsMedia releasesNational market updatesPersonal advisersPIPA AdviserPIPA Annual Investor Sentiment SurveysPIPA Member ProfilesPIPA video updatesPIPA webinarsPodcastsProperty advisersProperty newsLatest Articles

‘More chance of winning lotto’ than housing targets being met

PIPA Member Profile | Amanda Turner, Opulence Property

Annastacia Palaszcauk last month announced an urgent meeting of industry groups and stakeholders following pressure to take action on the devastating rent crunch, which has seen tenants struggle to find affordable housing on the back of rising demand and plummeting supply.

But formal requests to attend sent weeks ago by two peak groups for landlords – the Property Investment Professionals of Australia and the Property Investors Council of Australia – were ignored.

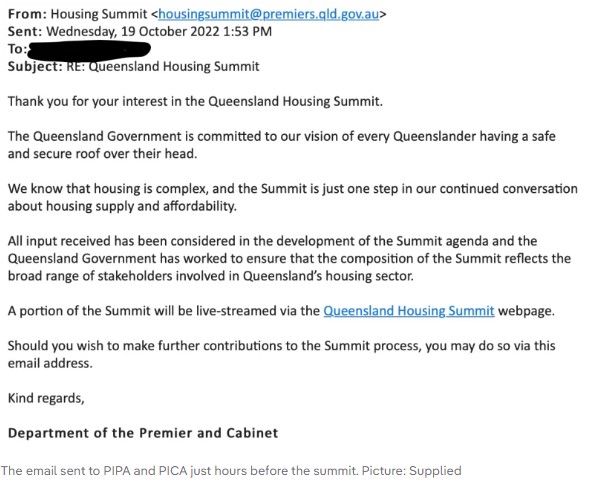

It was only after media inquiries on Wednesday, on the eve of the summit, that the Premier’s office finally sent a response to both groups advising that their requests were rejected.

“All input received has been considered in the development of the summit agenda and the Queensland Government has worked to ensure that the composition of the summit reflects the broad range of stakeholders involved in Queensland’s housing sector,” the email, sent at 1.53pm, read.

Nicola McDougall, chair of PIPA, said she was baffled by the silence and eventual rejection from the government given the critical role that landlords play in providing housing.

“It’s bizarre we have been snubbed given our recent investor sentiment survey helped to shine a light on the fact that investors had already deserted the Queensland market,” Ms McDougall said.

“Addressing the critical undersupply of rental properties in Queensland requires the input of all stakeholders, including investors who are the biggest providers of rental housing in the state, but perhaps the premier is not interested in the vital role they play in society.”

In announcing the roundtable, Ms Palaszczuk said it would comprise senior figures within government, the Local Government Association of Queensland, Brisbane’s Lord Mayor, and a number of non-government stakeholders.

“Nothing is more important than having a roof over your head – it’s a basic need – and the stories of people without secure housing are heartbreaking,” Ms Palaszczuk said.

The premier said a range of measures were being rolled out to improve housing supply, with more to be considered following the summit.

But her controversial housing tax hike, which was dumped after staunch criticism and warnings it would worsen the rent crunch, had undermined those efforts, Ms McDougall said.

Now, this “bizarre” snub of landlords was unlikely to instil confidence in those propping up rental supply.

“Our recent survey found that 29% of investors are considering selling a property because of changing tenancy legislation making it too costly or hard to manage [their investments].

“[That is] followed by the threat of losing control of their asset because of new or potential government legislation (27.5%), and the threat of rental freezes being enforced by governments (23%).

“If the percentage of investors who are considering selling wind up doing so, then we are going to see even higher rents as well as a sharp increase in homelessness – especially in Queensland, given 45% of investors sold at least one dwelling there in the two years to August.”

That two-year reduction in supply equates to about 162,000 dwellings across the state, she said.

Ms McDougall said her organisation had been warning about a looming housing crisis for years, but those warnings fell on deaf ears.

“When we warned about the potential impact from lending restrictions on rental supply back in 2017, no one took any notice, and when we started highlighting the looming rental undersupply some two years ago, again, we were [painted] as real estate zealots,” she said.

“It is clear that investors are sick and tired of being treated appallingly by policymakers who continually believe that they are an endless supply of revenue for their coffers.”

Originally Published: Shannon Molloy | realestate.com.au | 19th October 2022