Australia risks sleepwalking into a housing catastrophe due to ‘illogical’ policies

Sep 2022Karen Millers

Categories

Location ReportsMedia releasesNational market updatesPersonal advisersPIPA AdviserPIPA Annual Investor Sentiment SurveysPIPA Member ProfilesPIPA video updatesPIPA webinarsPodcastsProperty advisersProperty newsLatest Articles

PIPA Member Profile | Amanda Turner, Opulence Property

Australia risks sleepwalking into an unimaginable housing catastrophe if governments implement more “illogical and unusual” policies, experts have warned.

And desperate tenants need only look to the dire situation in Ireland to get a glimpse of the future that awaits them, leading buyer’s agent Pete Wargent said.

The country of five million is in the grips of a shocking housing shortage, with just 716 available rental properties across all of Ireland last month.

Chaotic scenes shared on social media show hundreds lining up for hours to view scarce homes, and prices have jumped by 14% in a year – more in some parts of Dublin.

Some agents are receiving 1000-plus applications per property in recent months, The Daily Mail reports.

“Ireland [implemented] a series of measures to target so-termed ‘greedy landlords’, including rent controls, tax policy changes, and a moratorium on evictions,” Mr Wargent, co-founder of BuyersBuyers, explained.

“The inevitable result has been… landlords leaving the market in droves due to increasing regulation and taxes… and a chronic shortage of rentals and massive queues outside properties for rent.”

Like Australia, authorities in Ireland have failed to invest in adequate levels of social and affordable housing supply, putting further pressure on the private rental market.

And like here, Mr Wargent said property investors in Ireland have faced “increasingly challenging” conditions at the hands of governments, and the consequences are now evident.

‘Following a similar dangerous path’

A move by the Queensland Government to institute a housing tax that has been widely panned by industry groups is the latest example of what some see as ‘anti-landlord’ politics.

Under the changes, which come into effect in July 2023, state land tax will be levied on property investors based on the value of their assets anywhere in Australia, rather than just within the Queensland jurisdiction.

“It’s frankly a ludicrous proposal,” Ben Kingsley, chair of the Property Investors Council of Australia, said.

“Landlords who have holdings are effectively being double taxed with Queensland claiming the right to tax based on property that’s not even within its jurisdiction.”

Mr Kingsley agreed that the outlook for investors is increasingly grim and warned “we could end up like Ireland”.

“That’s the way we are heading with landlords being asked to cover increased holding costs in the form of higher mortgage repayments, higher compliance costs via new minimum standard rules, and threats of rental freezes.

“They regulated the market so tightly that investors sold up and took their investment dollars elsewhere. The ultimate losers are tenants and the broader economy.”

Queensland’s cash grab is the latest addition to a growing list of policy changes targeting landlords, Mr Wargent said, and a troubling sign that Australia is “heading in the direction” of a crisis similar to that erupting in Ireland.

“There’s been the restrictions on the deductibility of depreciation for properties bought after May 2017, major reforms to residential tenancy laws, including to the grounds for eviction and minimum property standards, and the introduction of a huge lending assessment buffer of at least 300 basis points for new borrowers.”

Queensland’s housing tax will “make being a landlord incrementally less attractive” and only result in further pain for struggling tenants, he said.

Hayden Groves, the president of the Real Estate Institute of Australia, said demonising investors ignores the important role they play in providing homes for millions of people.

“It is astonishing that policy makers still don’t seem to understand that rental market challenges derive from supply shortages not greedy landlords,” Mr Groves said.

On top of that, he said “anti-investor proposals” ignore the longer-term consequences of housing supply, which will impact heavily on the very people that are intended to support.

Forcing landlords out ‘bad for tenants’

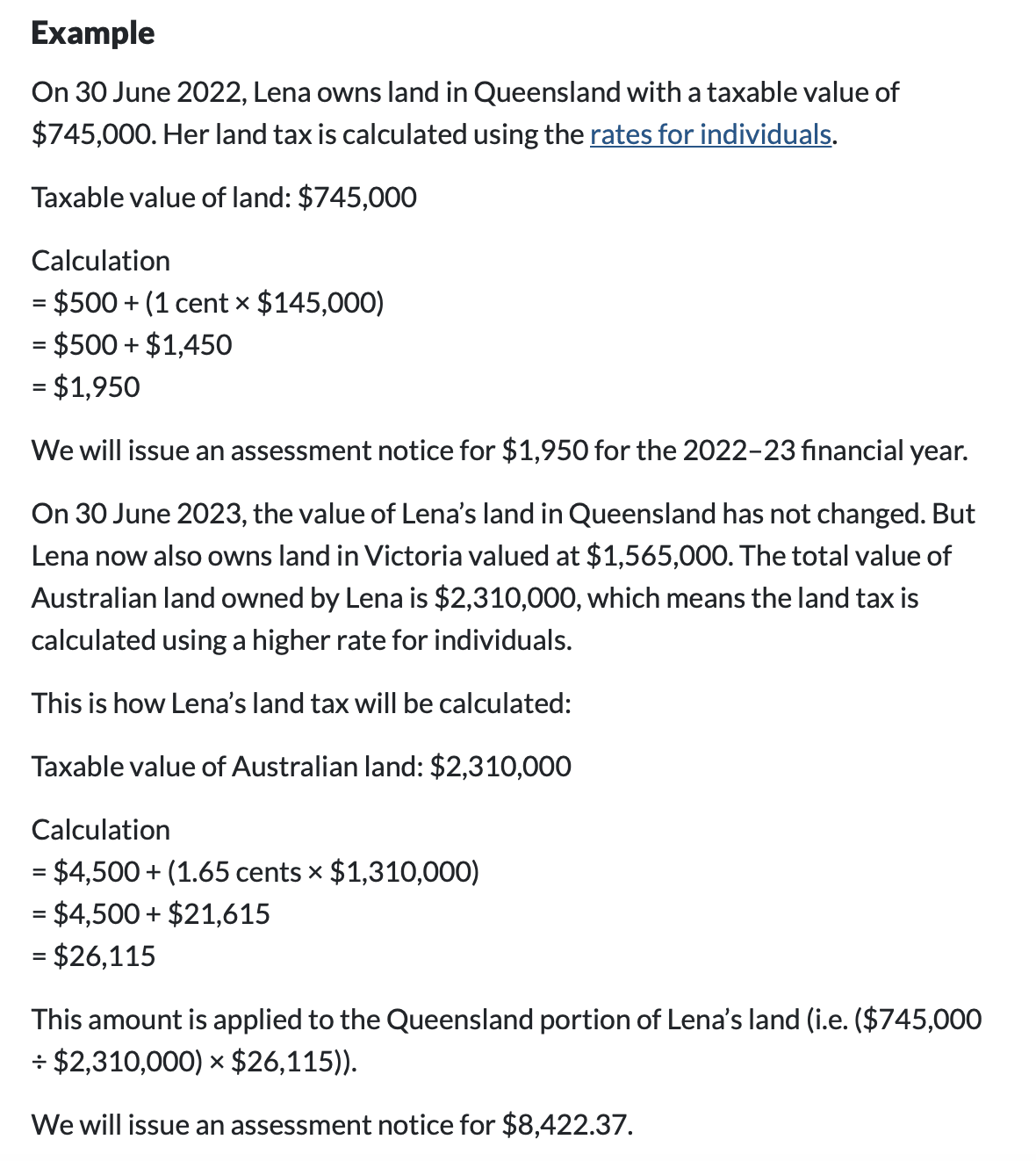

Many landlords stung by the hefty land tax hike – a rise of more than of more than 300%, based on the government’s own example scenario – will be forced to either lift rents to cover the significantly higher costs, or to sell up and leave the Queensland market, he said.

The example provided by the Queensland Government, showing a mammoth hike in tax. Picture: Queensland Government

“That will exacerbate an already chronic shortage of rental properties, particularly in the south-east corner of the state.

“The new tax legislation is both illogical and very unusual, and this unprecedented legislative reform runs contrary to the usual principles of taxation, penalising investors who own properties in other jurisdictions unnecessarily.”

The “biggest pain of all” will be felt by renters, he warned, who will face even tighter conditions and inevitable price rises.

“There will be catastrophic shortage of available rentals if Queensland experiences a net decline in the number of landlords in the current market conditions. Rents will skyrocket.”

Cameron Kusher, director of economic research at PropTrack, said “it’s clear renters will likely be the ones to lose out” from the cash grab.

“It has been suggested that these changes are about levelling the playing field for locals who are competing with wealthy interstate purchasers for property,” Mr Kusher said.

“However, if the aim is to help locals from being priced out of the market by interstate buyers, this new law falls short.”

Nicola McDougall, chair of the Property Investment Professionals of Australia, said investment activity across the country has been declining for the past five years.

That slump is on the back of restrictive lending reform and unattractive legislative changes that have dissuaded new landlords from investment and forced others to sell.

“There is no question that Queensland’s housing tax will see even more investors leave the market and cause an increase in homelessness because the rental market is already severely undersupplied,” Ms McDougall said.

Government coy on tax details

When announcing the housing tax, Queensland Treasurer Cameron Dick insisted it merely “closed a loophole” and was a way of ensuring interstate investors pay their fair share.

But industry groups have accused the government of “slipping the bill through parliament” without conducting proper consultation and while refusing to provide detail, including releasing Treasury modelling.

Mr Dick was also last week forced to concede that the tax grab would impact local investors, after initially insisting only interstate landlords would have to pay.

Real Estate Institute of Queensland chief executive officer Antonia Mercorella said it’s a sign of how little legal and taxation advice the government had sought from “suitable qualified stakeholders”.

“This new land tax regime is as unique as it is illogical,” Ms Mercorella said.

“There’s no other state or territory that charges state land tax based on the value of properties held across Australia and outside the jurisdiction where the tax is collected. It’s unprecedented and unheard of for a reason.

“It is irreconcilable that the Treasury expects to legitimately raise tax on the basis of value of property held outside of Queensland, for the purpose of funding infrastructure within Queensland.”

Originally Published: Shannon Molloy | realestate.com.au | 15 September 2022