The 10 “hottest” property markets around the nation revealed

Oct 2025PIPA Admin

Categories

Location ReportsMedia releasesNational market updatesPersonal advisersPIPA AdviserPIPA Annual Investor Sentiment SurveysPIPA Member ProfilesPIPA video updatesPIPA webinarsPodcastsProperty advisersProperty newsUncategorisedLatest Articles

The 10 “hottest” property markets around the nation revealed

TEA TREE GULLY : North Eastern Suburbs of Adelaide

Safeguarding Property Businesses Against Cyber Threats

Young purchasers sidelined as key buyer group returns to market

The “hottest” property markets in the nation have been revealed with three states featuring all of the top performers, according to new exclusive research and analysis.

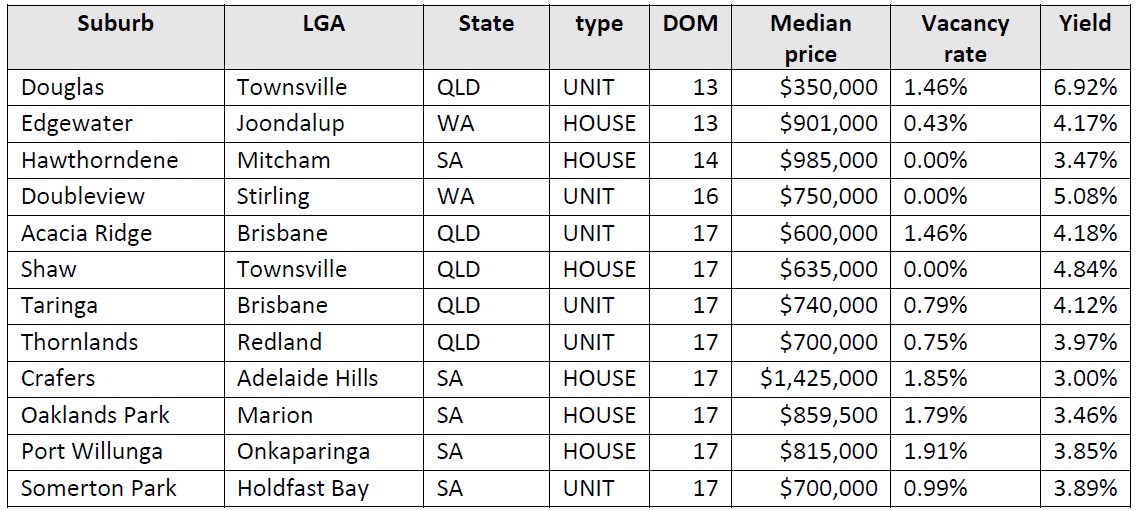

The new Hotspotting research considered locations that had the powerful combination of low days on market as well as low vacancy rates, solid yields, as well as a history of regular property price growth.

Hotspotting Director Terry Ryder said the top suburbs share a number of commonalities, such as being located outside of New South Wales and Victoria, but also most are considered affordable property areas more generally.

“With the exception of Crafers in the Adelaide Hills, all of the other suburbs have median prices below $1 million for houses, and well below that again for units,” he said.

“Tied for number one position are units in Douglas in Townsville with an average of 13 days on market as well as a median unit price of just $350,000 and price growth of nearly 17% over the past year.

“Houses in Joondalup in Perth also have 13 days on market with median price growth of nearly 12% in the past year and a median house price of $901,000.”

Hawthorndene in Mitcham in South Australia was next with 14 days on markets and Doubleview in Stirling in Perth next on 16 days.

Mr Ryder said the results underpin his long-standing hypothesis that it is the more affordable property markets and regions that have the best price growth over the medium- to long-term.

“It’s highly unlikely that many property pundits picked Acacia Ridge in Brisbane or Port Willunga in Adelaide to be market outperformers a few years ago, but here we are,” he said.

“Not only are all of these markets currently hot, but they have recorded above average annual median price growth over the past five years – ranging from 7.18% in Douglas to 15.88% in Port Willunga.

“Every single property buyer and investor would be very happy with this type of property growth but many probably bought in much more expensive markets.”

The 10 “hottest” property markets around the nation

Source: Hotspotting.com.au

PIPA Chairman Lachlan Vidler said investor activity had finally started to improve over the past year, but there was still a long way to go before rental supply increased significantly.

“Another telling element of this research is the fact that each one of the top locations has a vacancy rate of less then two per cent with some, such as Hawthorndene, Doubleview and Shaw, recording a vacancy rate of zero,” Mr Vidler said.

“A vacancy rate of three per cent is considered a balanced rental market and these top 10 areas are nowhere near that level, which is why their rents also increased over the past year, including 17% in Acacia Ridge and 28% in Crafters.”

Mr Vidler said more investors were also taking a nationwide view when considering where to purchase next.

“Working with qualified property investment professionals, who are appropriately licensed in the states and territories they operate in, as well as having plenty of experience and successful results for their clients, is imperative to prevent costly mistakes when purchasing in unfamiliar or interstate markets,” he said.